This is known as amortization or allocation of the prepaid expense over the period that it is expected to benefit the business. When you buy the insurance, debit the Prepaid Expense account to show an increase in assets. The most important calculation regarding prepaid Prepaid Insurance Definition, Journal Entries insurance reflects the unexpired portion of the policy. At the end of each month, an adjusting entry of $400 will be recorded to debit Insurance Expense and credit Prepaid Insurance. Company XYZ has paid an insurance expense of $500 for the next quarter.

Prepaid expenses only turn into expenses when you actually use them. The value of the asset is then replaced with an actual expense recorded on the income statement. Prepaid expense is first recorded as an asset and later debited as an expense. Hence, it can be recorded by using the asset method and expense method of accounting. The same journal will repeat for each month till December, when the balance in the prepaid rent account will be zero.

Prepaid Expenses

Simply sticking with ‘the way it’s always been done’ is a thing of the past. To sustain timely performance of daily activities, banking and financial services organizations are turning to modern accounting and finance practices. It’s no longer a matter of whether or not to digitally transform.

As per the rules of accounting, expenses can only be recorded when they are incurred. Hence, tax on an advance expense can only be deducted in the year to which it applies. In this way, the asset value of https://kelleysbookkeeping.com/purpose-of-an-iolta-checking-account-for-a-lawyer/ the prepaid insurance will be reduced to zero at the end of the time period which was paid for in advance. Similarly, the expense will reach the total of the prepaid amount at the end of that same period.

Prepaid Expenses Example

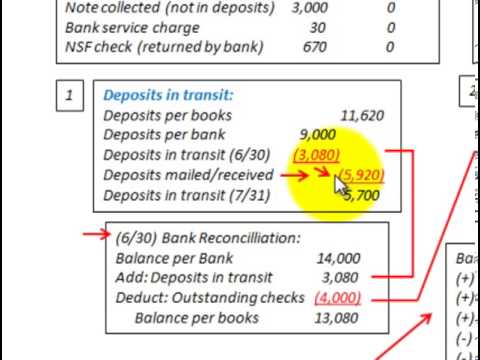

This reduces the number of entries required, saving time and reducing the risk of errors. During this period, companies must transfer the expired portion of the premium to the income statement. The journal entry for this aspect of prepaid insurance is as follows. The business’s records would show four months of insurance policy as a current, prepaid asset. It would be entered into the general ledger as a debit of $12,000 to the asset account and a credit for the same amount to the cash account. Prepaid insurance is recorded in the general ledger as a prepaid asset under current assets.

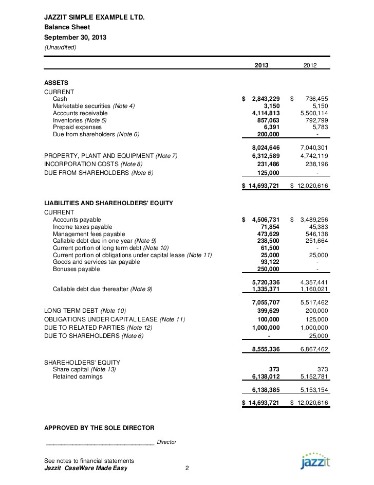

- By treating prepaid expenses as assets, businesses can accurately reflect the value of future economic benefits on their balance sheet.

- Repeat the process each month until the rent is used and the asset account is empty.

- Companies come to BlackLine because their traditional manual accounting processes are not sustainable.

- It is considered a prepaid asset, which is a way to express these benefits in accounting terms.

- A prepaid expense is a payment made in advance for goods or services that will be received in the future.

When a business pays for goods or services in advance, it expects to receive the benefits of those goods or services over a period of time. For example, if a business pays for a year’s worth of insurance premiums upfront, it expects to receive the benefits of that insurance coverage over the course of the year. Prepaid expenses refer to payments made by a business for goods or services that will be consumed in the future. Essentially, a business pays upfront for a good or service, and the benefit is received over time. Examples of prepaid expenses include insurance premiums, rent, or subscription services.

Stay up to date on the latest accounting tips and training

The advance payment of expenses does not provide value right away. Rather, they provide value over time; generally over multiple accounting periods. The reason is that the expense expires as you use it, thus, you can’t expense the entire value of the prepaid service immediately. You can only expense a portion of the expense that has been used. So when making a journal entry for prepaid insurance, you record the prepaid expense in your business financial records and adjust entries as you use up the service.